when will i receive my unemployment tax refund 2021

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. Can you track your unemployment.

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of.

. The IRS has sent 87 million unemployment compensation refunds so far. Thats just an estimate however -- it wont be finalized. Not at this point - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our.

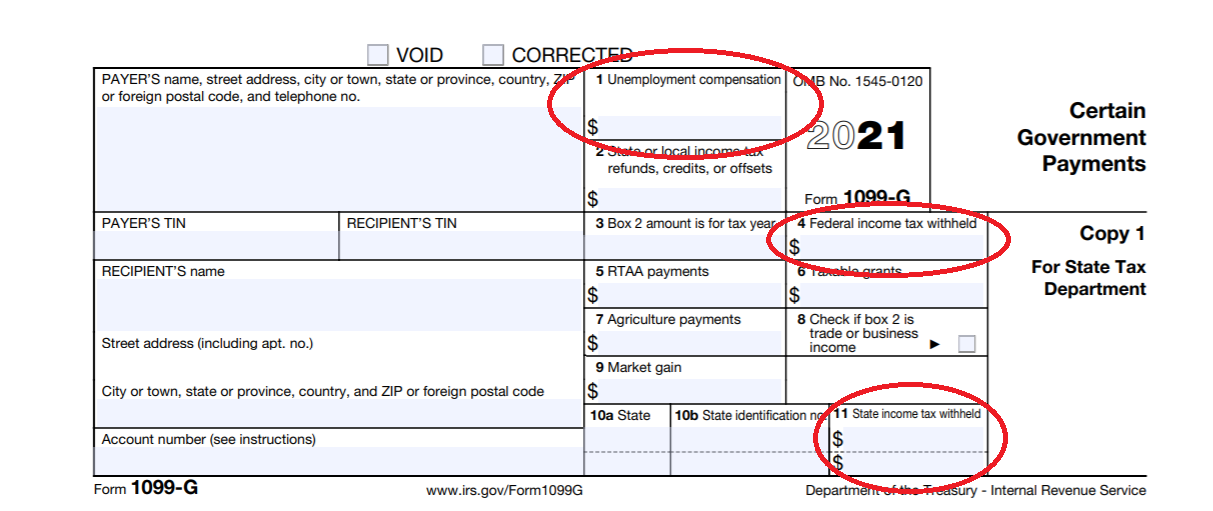

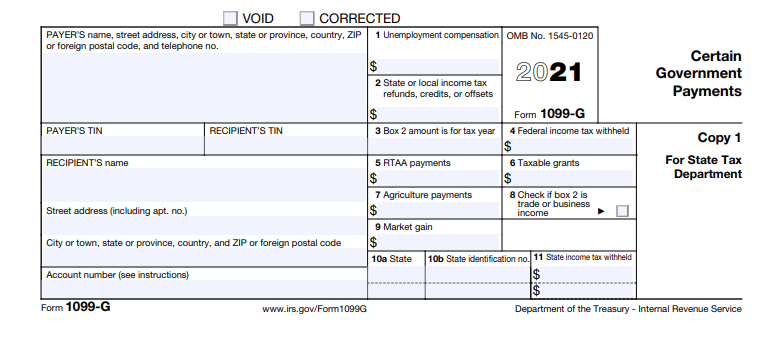

By Anuradha Garg. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income. Account Services or Guest Services.

I filed my taxes on March 26 2022 but have not seen a refund. The amount of qualifying expenses increases from 3000 to 8000 for one qualifying person and from 6000 to 16000 for two or more. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer.

ANCHOR payments will be paid. We will begin paying ANCHOR benefits in the late Spring of 2023. If you paid taxes on unemployment benefits received in 2020 you might get a refund or the IRS could seize it.

The deadline for filing your ANCHOR benefit application is December 30 2022. The administration previously said the credit would be a refund of approximately 13 of their 2021 state income tax liability. Reporting unemployment benefits on your tax return You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional.

After the November deadline those who missed out can still file a 2021 tax return. The IRS urges filers to gather certain forms before claiming to make the process smoother. 11 2021 Published 106 pm.

22 2022 Published 742 am. Premium federal filing is 100 free with no upgrades for unemployment tax filing. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022.

If you use Account Services. The 10200 tax break is the amount of income exclusion for. The IRS might seize.

The agency is working its way down to the more complex category and expects to complete releasing jobless tax refunds before Dec. For tax year 2021 the taxes you file in 2022. The IRS will continue reviewing and adjusting tax returns in.

At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns. The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414 in 2021. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

You may check the status of your refund using self-service. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. There are two options to access your account information.

We will mail checks to qualified applicants as. Check For The Latest Updates And Resources Throughout The Tax Season. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion.

2020 Unemployment Tax Break H R Block

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

2021 Tax Refund Why Have I Not Received My Payment As Usa

Irs Will Automatically Refund Taxes Paid On Some 2020 Unemployment Benefits Ds B

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Where Is The Irs Unemployment Tax Refund Tax Refund 2021 Update 300 Unemployment Boost Youtube

Unemployment 10 200 Tax Break Some States Require Amended Returns

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break

The Ui Tax Refund On My Transcript 1 229 23 Is Less Then The Unemployment Taxes Paid 2 606 Shown On My 1099g Is There Any Reason For This R Irs

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

Irs To Recalculate Taxes On Unemployment Benefits Refunds To Start May 2021 Tax Pro Center Intuit

Accessing Your 1099 G Sc Department Of Employment And Workforce

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Irs Refund 2021 Will I Get An Unemployment Tax Check

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

Money Monday How To Get Taxes Back On Michigan Unemployment Payments

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun